How America Pays Taxes—in 10 Not-Entirely-Depressing Charts

A brief history of where your money goes and why

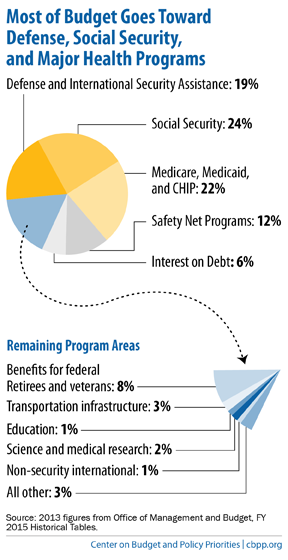

Defense and insurance. It might not surprise you that about $1 in every $5 of federal taxes paid goes to defense. But the rest of the budget is overwhelmingly designed to insure the old and poor and provide a safety net. Social Security, Medicare/Medicaid/CHIP, safety net programs, and veterans' benefits account for nearly two-thirds of the budget (not including interest paid on our debt). This great chart is from the Center on Budget and Policy Priorities.

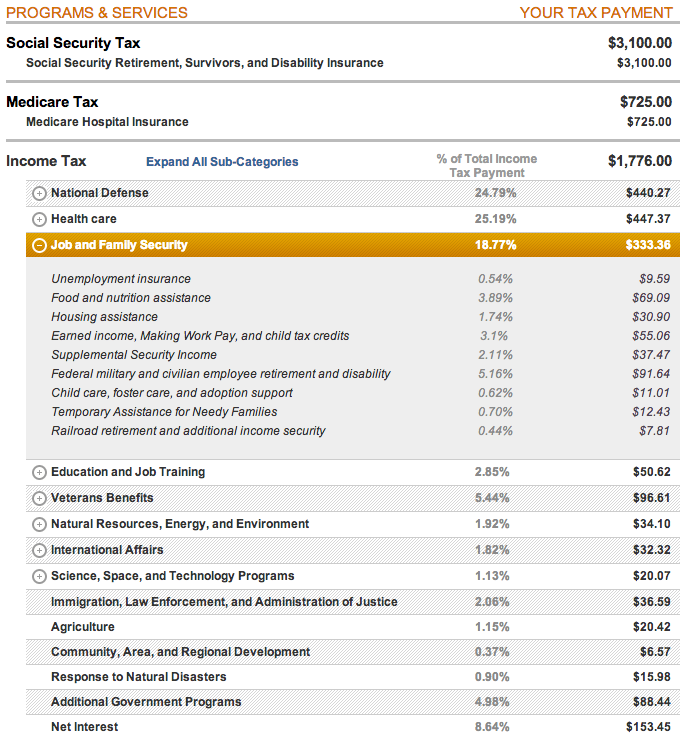

Actually, I'd prefer a more detailed description of exactly where my federal taxes go.

Okay, let's say you're a family making $50,000, married with one child. Let's also say you put 2 percent of your wages toward a 401(k), don't itemize, and claim the Saver's Credit and Child Tax Credit. This is what your tax receipt might look like. You're paying $440 to have the finest military on the planet. You're paying $9.59 on unemployment insurance. You're paying $15.98 to ensure that the federal government can help you out if there's a natural disaster that takes out your town. You're also paying about $4,000 in Social Security and Medicare taxes.

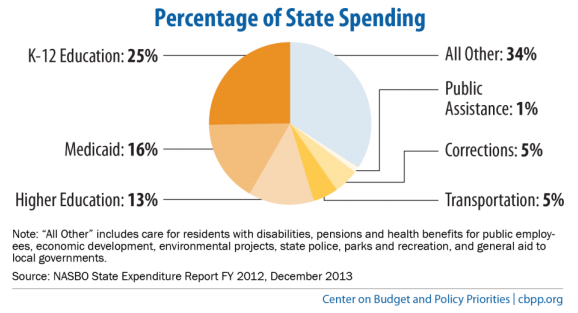

What about my state and local taxes? Where do they go?

Commentators, unlike taxpayers, tend to forget about state and local taxes when they make pronouncements about who pays what. But Americans fork over nearly $1 trillion in state and local levies each year. This pile of money goes mostly to education and health care.

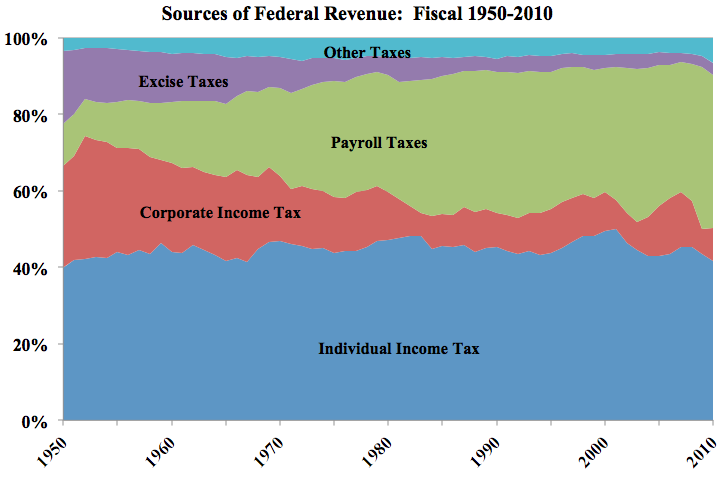

How does the federal government make money?

Washington has two big money streams, which together account for 80 percent of all federal income: (1) payroll taxes, which are split between employers and employees to fund programs like Social Security, and (2) income taxes, which you're all too familiar with now that it's the middle of April. The media tends to focus on income taxes, because they are the main arena of battle between Republicans and Democrats. But payroll taxes make up just about the same share of government revenue, especially since corporate income taxes have shriveled in the last 60 years as a share of the total pie. [Tax Policy Center]

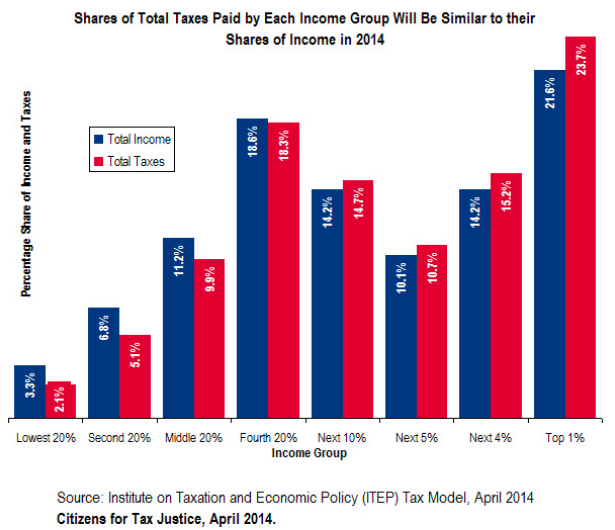

Interesting question. The federal tax code is basically progressive. Richer people tend to pay higher effective taxes (even though wealthy people who make most of their income from capital gains and dividends benefit from low rates designed to encourage saving and investing). But sales taxes and gas taxes are regressive. As a result, the share of total taxes paid by each income group is fairly similar to the share of income, as the left-leaning Citizens for Tax Justice has argued. So yes, the tax code is progressive. But not as progressive overall as you might think, or hope.

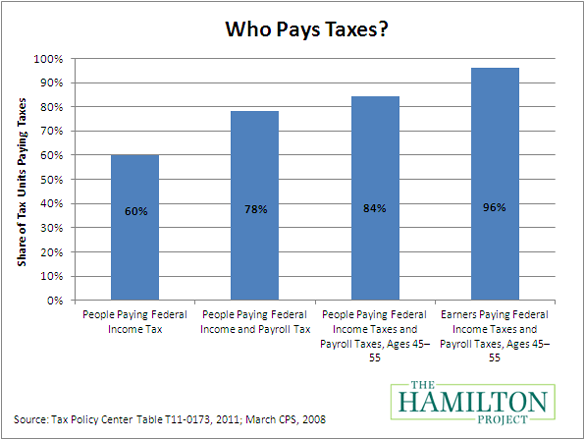

Is it true that nearly 50 percent of families don't pay taxes?

No. This is a fun talking point, but like most talking points, it's woefully incomplete. While it's true that about 50 percent of families don't pay a positive federal income tax, remember than an equal share of federal government revenue comes from payroll taxes. Practically all earners in their prime-working years pay a total federal tax, as this Hamilton Project graph shows. (Plus, you probably pay sales and excise taxes every time you pay for dinner or fill up your car with gas.)

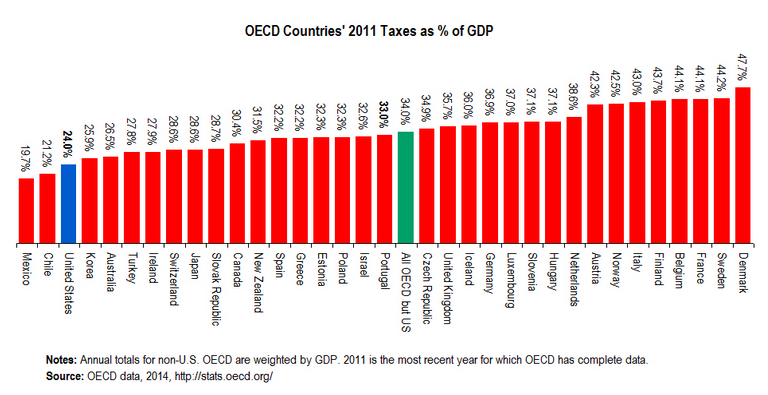

This is a hard question to answer definitively. As Michael Linden of the Center for American Progress pointed out to me last year, the U.S. ranks in the bottom five among OECD countries in total government revenue as a share of GDP. We're just above South Korea and Turkey. We tax less than Australia, Canada, and just about every country in Europe. This graph from CTJ uses 2011 data, but the story hasn't changed much: We're a pretty low-tax country.

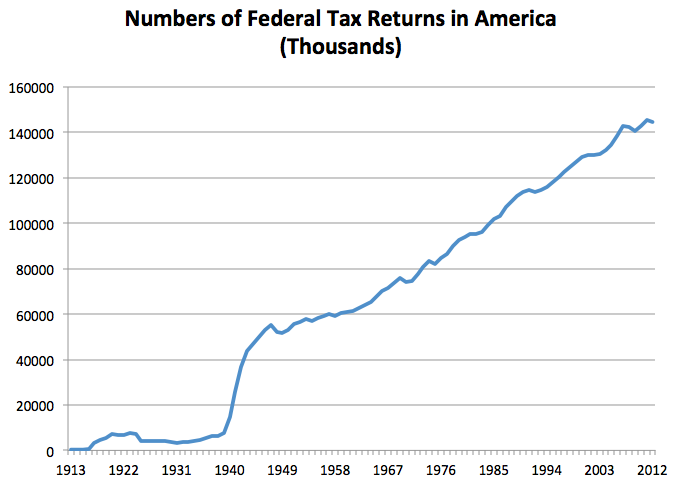

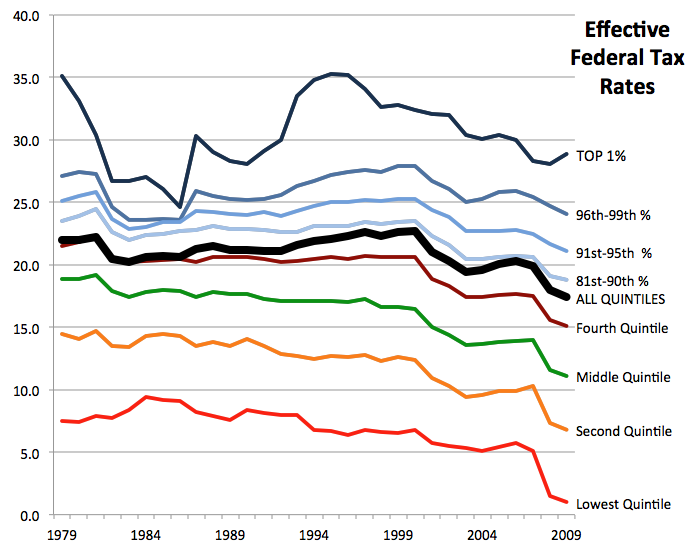

Are we paying more than we used to?

Yes, if you compare to, say, 1879. No, if you compare to, say, 1979. Tax rates have declined dramatically in the last 30 years for just about every group of tax payers. Effective tax rates have fallen by between three and eight percentage points since the Reagan administration took office for just about everybody. Note that although this historical dataset from the Tax Policy Center ends in 2009, the first year of Obama's presidency, taxes have gone up for the richest Americans in the Affordable Care Act and in the deal to avert the Fiscal Cliff.

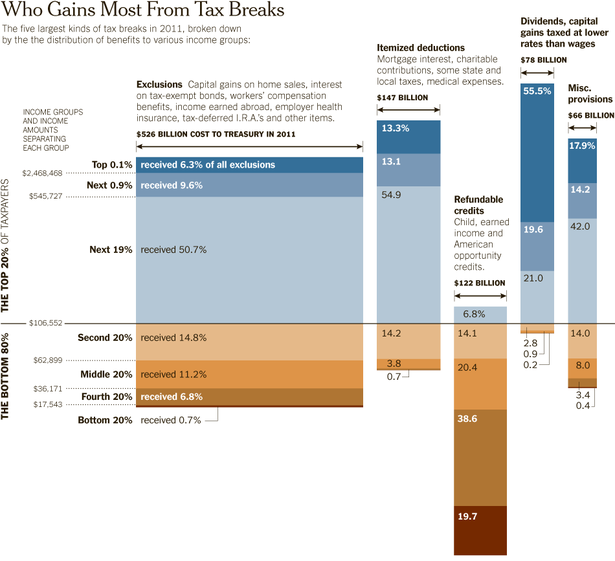

Who benefits the most from tax breaks?

So far, we've talked a lot about how the government uses taxes to take money. But we haven't talked about how the government uses the tax code to spend money, or leave money in the hands of families who behave in a certain way. Two yeas ago, the Times drew a magnificent graph of who benefits from the $1 trillion in tax breaks hidden within our law. The upshot is that, just as the rich pay the most taxes, they benefit the most from tax breaks. Refundable credits, which offer lower income families the opportunity to earn money from the federal income tax law, include child credits, college credits, and the earned income tax credit. The majority of capital gains benefits accrue not to the 1%, but to the 0.1%. That's one reason why our largely progressive tax code actually becomes slightly regressive at the very top, as more and more money comes from via tax-preferred investments.

This post is adapted from an article we originally published on April 16, 2012.